Clustering Illusion Example

The 'Illusion of Asymmetric Insight' occurs where we believe we understand others better than they understand themselves. This is an example of the quality of a High Definition Presentation and you should see a crisp image if your Internet connection is fast enough to.

Everyone has their versions of the world, depending upon how they visualize it. The underlying fact is that, though we are so-called ‘rational’ beings, we all are subject to some form of irrationality. And that irrationality is caused by various biases and illusions known as ‘Cognitive Biases’, an umbrella term. Cognitive biases are systemic patterns of deviation from the sense of rationality. It refers to an error in thinking which happens when people are interpreting and framing information in the world around them, upon which they base their decisions. There are many cognitive biases that a human mind is subject to, out of which Clustering Illusion is one.

What is Clustering Illusion? And why you see shapes in the clouds. Consider the following examples: Example 1. In 1957, Swedish opera singer Friedrich Jorgensen bought a tape player to record his vocals. When he listened back to the recording, he heard strange noises throughout, whispers that sounded like supernatural messages. The illusion is due to selective thinking based on a counterintuitive but false assumption regarding statistical odds. For example, it strikes most people as unexpected if heads comes up four times in a row during a series of coin flips. However, in a series of 20 flips, there is a 50% chance of getting four heads in a row (Gilovich).

What is Clustering Illusion?

Clustering Illusion is a human tendency to perceive random data sets to be non-random and revealing a pattern. Seeing shapes in a cloud would be the simplest example. We see shapes and patterns where there are none. We all are subject to illusions and biases. And in fact, these biases and illusions are the biggest self-imposed obstacle to progress, not only for oneself but in the end, for all.

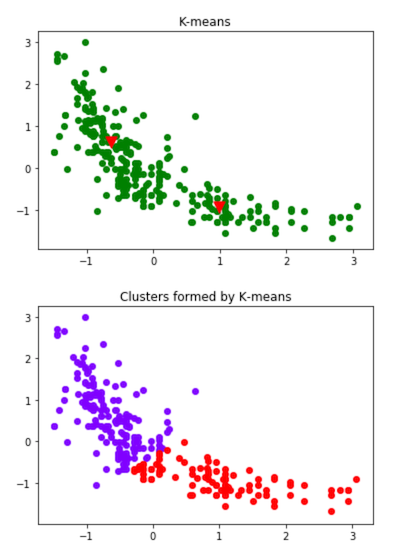

The scatter plot produced here consists of 800 random data points. At first glance, our so-called creative minds will try to seek out patterns in the plot with whatever little data pre-exists with us and even find relationships between the variables. The fact that the plot is completely random shows the biases of the human mind – an example of Clustering Illusion.

Finding Order from Chaos

Simon Sinek, an author and a motivational speaker, may well be right when he said that the ability to find order from chaos is called creativity. But for psychologists and alike, in statistical terms, this ability is a normal tendency of all human beings. According to them, finding order from chaos is as natural an inclination as sand ripples created by wind. The human mind tries to search out for meaning in whatever little information it has. Although this helps individuals make meaning of the randomness around them, Clustering Illusion makes their decision biased. And these biased decisions can do serious harm while trading securities or making decisions or even in the field of market research.

Clustering Illusion at Work

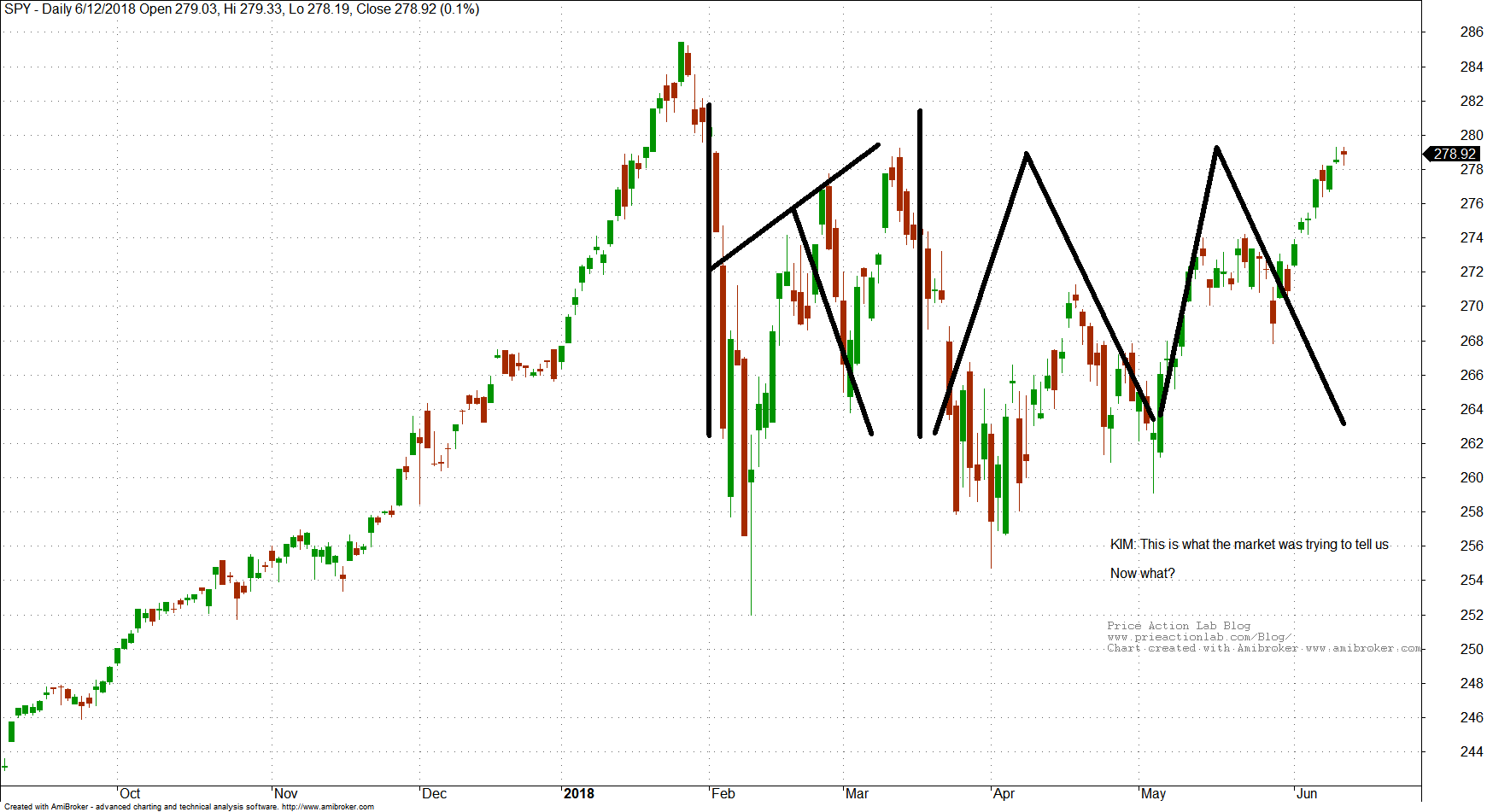

- Investors usually indulge in a tug of war between their analytical brains and their emotions. While these emotions are at play, Clustering Illusion is at its best. While using charts and candlesticks, one might interpret a cluster of strong returns as a trend, while in truth; they are just a part of normal variations of returns.

- Short-term performance data can persuade us to emphasize on a particular stock or a specific class of investment, such as bonds, Exchange Traded Funds (ETFs), etc. It may even lead to us changing our investment style and habits. Research shows that the returns of a mutual fund for two consecutive years are barely correlated (a little higher than 0). We are also aware of the fact that ‘past performances are not indicative of future performance’ and yet, very commonly, we tend to see the past performance of mutual funds to determine whether to invest in it or not.

- Even while evaluating managers, we tend to fall for Clustering Illusion. A short run of right decisions or returns could be a matter of pure luck while Clustering Illusion may force us to believe against it.

We need to understand the importance of luck when making decisions in the short run. And that includes randomness. Markets and even the world surrounding us is often random. Many things indeed experience a short and intense cycle. But, these tend to regress to the mean in the long run. We need to have an adequate amount of scepticism while making decisions, as we know that intuition can mislead us.

Is Optimism always good?

Optimism is highly valued in society and those taking quick and optimistic decisions are fairly rewarded too. But this same unwarranted optimism was one of the big reasons for the Great Financial Crisis of 2007-08. People of the United States were highly optimistic about housing prices going up. They undervalued risk due to such high optimism. Risk models of banks and investment firms were data-driven. They put the data for the past 20-30 years, a period of stability, and the model would return a very low probability of any disaster as such. Clustering Illusion was at play. The people did not realize that their models were outdated. Countries like Japan and Russia had faced instability in the 1990s. So their risk models would show a fair amount of volatility. They had no such illusion. Therefore, their economies did not suffer much during 2008. Here arises a need for a better understanding of risk management also.

Can we Control such an Illusion?

While we all are susceptible to Clustering Illusion, not all of us know about it. And those who know about it feel helpless. Clustering Illusion results from the human brain under-predicting the probability of variation in data in the short run. Hot or cold streaks in the short run are difficult to be reasoned out. They may happen due to luck or any other factor unnoticed. Although the concept of such illusions and biases are in-built in the human brain, steps can certainly be taken to avoid hitting such illusions all the time.

What steps should we take?

- We should not put much emphasis on the data in the short run. Rather, we should gather more data and make sure our sample size is large enough.

- We should reason out our intuitions since they can often mislead us. Our intuitions and beliefs should be in line with the facts while making any decision. Besides, as Daniel Kahneman stated in his book ‘Thinking, Fast and Slow’, intuitions cannot be trusted in the absence of stable regularities in the environment. Beliefs should make way for facts.

- Disciplined strategies and fact-based rules should be employed to make decisions regarding stocks and investments.

- In the organizational level also, the behavioral aspect of the organization should always be kept in mind and regularly checked.

Conclusion

Everyone makes bad decisions now and then. But it is only a few who analyze why. While Clustering Illusion is one such reason, it is clear that it can be avoided by rigorous analysis before any decision making, all the while striking a good balance between being a sceptic and being overly delusional. ‘Have strong opinions, loosely held!’

Contributor: Gaurav Jalan

Research Desk Leveraged Growth

I am currently pursuing B. Com (Honors) from St. Xavier’s College, Kolkata, along with FRM Part-I. Along with a strong foothold in academics, I am an avid reader of various genres. I also keep a special interest in current affairs, politics, and sports. I continuously drive myself to acquire new skills and learn something new every day. With perseverance and patience, I aim to give whatever task at hand my very best.

SYNGENE INTERNATIONAL LIMITED

Monthly Snapshot – February 2021

ADVANCED ENZYMES TECHNOLOGIES LIMITED

S CHAND & COMPANY LIMITED

INFO EDGE (INDIA) LIMITED

Facebook: Is it Connecting or Disconnecting people?

TATA COMMUNICATIONS

TATA MOTORS

Monthly Snapshot – January 2021